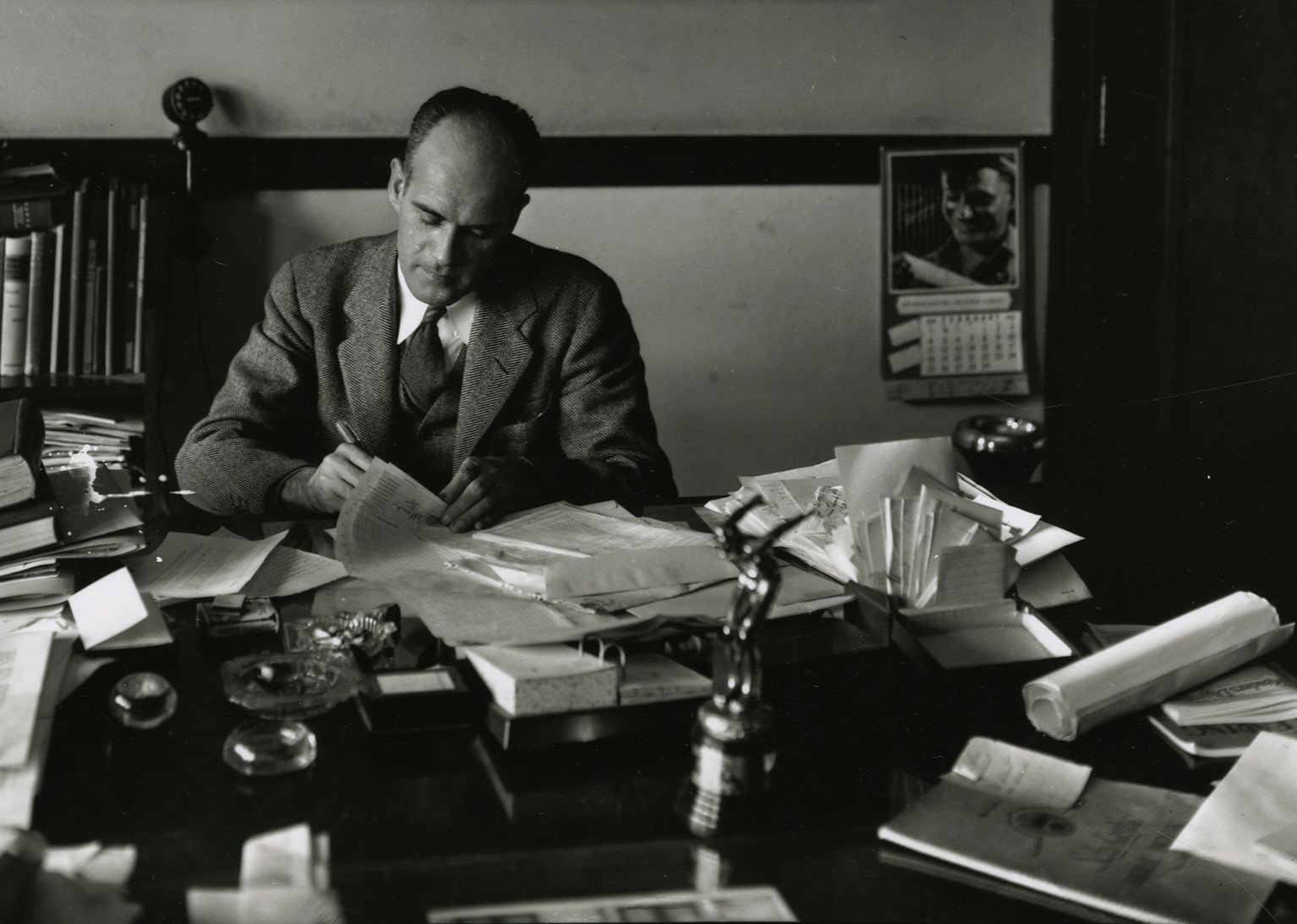

Detail of "John Varnedoe," 1940. From the Cordray-Foltz Photography Studio photographs collection: GHS 1360-PH-25-16-15.

While many of us may be slightly beyond 30-something, there are only 30-something days left in the year of 2023. Now, in late November, we may be rushing to accomplish all those things we promised ourselves we would take care of earlier in the year. So, as we plan for year-end, here are a few things to keep in mind:

- If you plan to make financial gifts to your children or other family members during 2023, remember that the annual exclusion amount that can pass free of gift tax is $17,000. An individual can gift up to $17,000 each to individual family members or friends without having to worry about paying a federal gift tax. This method of giving can provide a relatively simple transfer of wealth to members of your family. For example, if you are married, you and your spouse could give up to $34,000 to a grandchild without paying gift tax. In addition, you could pay his or her college tuition directly to his or her college or university without those funds being considered a gift.

- If you plan to make large gifts to family members or others by check, please be sure that the check is cashed, if possible, by December 31, or, at a minimum, mailed by December 31.

- If you plan to make gifts of stock, remember the value of the gift is the fair market value (average/mean) of the stock on the day of transfer. The recipient of your gift generally will acquire your cost basis (the amount you paid for the stock). Thus, it’s possible the recipient of your gift might have to pay some capital gains tax if they need or want to sell your stock shortly after you have gifted it. This differs from inherited stock, as the cost basis of any stock inherited from an estate will receive a “step up” in basis as the cost basis is deemed to be the fair market value as of date of death. If you transfer stock to a qualified charitable institution (like GHS) to make a year-end gift, the institution will be able to take advantage of the full value of the stock gift, without having to pay any taxes on the sale.

- If you plan on making any larger gifts via the methods above, please consult with your financial advisor soon to allow both you and your advisor ample time to work on a plan of giving that makes sense for you and your family.

- Finally, as you review your 2023 giving, please consider a gift to the Georgia Historical Society so you can help to sustain educational programming throughout Georgia in the New Year and beyond. Please give at www.georgiahisory.com or call us at 912.651.2125 Ext. 141 to learn more about our statewide educational programs for K-12 and our research mission.

During this season of gratitude, we are thankful for you. Happy Thanksgiving from all of us at the Georgia Historical Society!